ERC Program

ERC specialists who help businesses reliably claim their COVID support funds from the CARES act

Get up to $26,000 per employee from the IRS.

Did your business experience a suspension of services by government order during the pandemic? You may still qualify for the Employee Retention Credit (ERC). Our partner, Omega Tax Credits, has already helped hundreds of companies determine their eligibility and leverage the tax credit. In fact, they recently helped an early childhood education facility with 16 employees in California receive an ERC refund of over $187,000! They can help you, too.

How Does ERC Work?

How to Qualify

Revenue Impact

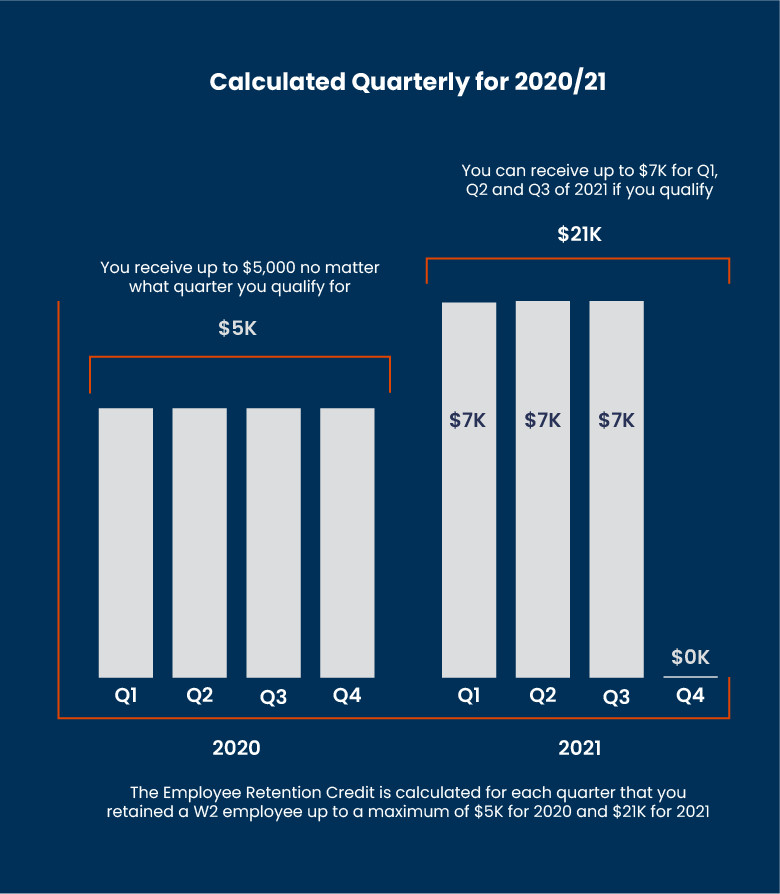

Quarter by quarter

comparison

The easiest way to qualify for ERC is through a basic revenue test. The IRS is trying to identify if you had a significant decrease in revenue in either 2020 or 2021 when comparing that back to 2019.

Operational Disruptions

Missed revenue opportunities due to externals factors

There is an additional way to qualify for the employee retention credit by justifying that your business experienced operational disruptions from any COVID mandates or government orders.

Our partner’s specialized team will ensure that you receive the maximum ERC that you qualify for without taking on unnecessary risk. We perform extensive due diligence to keep your business safe.

Step 1

10 minute call to qualify.

Step 2

Detailed ERC eligibility assessment.

Step 3

Analyze impact of government orders.

Step 4

Calculate refund and file with IRS.

Common Questions About ERC Funding

No, there are no legal requirements regarding how you spend your ERC refund check. The ERC is a tax refund — not a government loan or grant. This means that business owners are free to invest the ERC money to expand their company, pay business expenses and debts, or simply take the money home as a profit. The IRS cannot penalize your business for spending its ERC money in a particular way — it’s your money to spend as you please.

The ERC is neither a loan nor a grant. It’s a refundable tax credit — the IRS refunds you a percentage of the cash you have already paid in payroll taxes. The ERC differs from PPP because you do not have to pay back any amount of your ERC refund, nor apply to have it “forgiven.” Once you receive the refund check, you are free to spend it how you see fit.

Your ERC refund does count as taxable income — it’s just like any other income for your business. You will have to pay business income taxes on your ERC refund check at the end of the quarter.

If a business filed an income tax return deducting qualified wages before it filed an employment tax return claiming the credit, the business should file an amended income tax return to correct any overstated wage deduction. You can read more on this IRS page.

Due to a backlog at the Internal Revenue Service (IRS), it typically takes about six to nine months to receive the ERC refund check. There are only three IRS submission processing centers that serve the entire nation, leading to long wait times for almost any tax credit claim. That’s why it’s critical to have tax credit experts on your side who can quickly process your claim. The sooner your 941-X is submitted to the IRS, the sooner you can receive your ERC refund check.

As your ERC service provider, Omega Tax Credits can get your amended payroll tax return submitted to the IRS within 30 days of onboarding as our client. We can typically move as fast as you can provide the relevant documents and information.

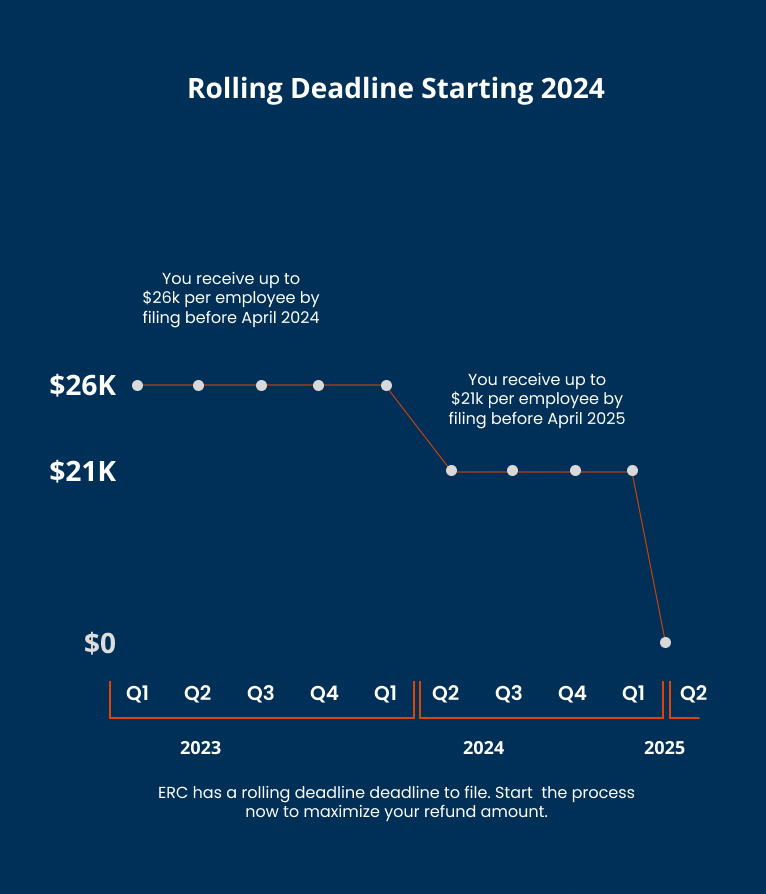

Yes, you can still apply for the ERC in up until April 15, of 2025 by submitting an amended payroll tax return claiming the Employee Retention Credit for the specific quarters in which your company qualifies. You must file your amended 941-X tax return within three years of the date you filed your original 941 payroll tax document. If you do not file by April 15 2024, you will no longer be able to claim ERC refunds you would have qualified for in 2020.

You can call the IRS and check on the status of your refund. They will provide a general update if they have received the form. However, the IRS generally has long hold times due to a shortage of phone operators. We recommend checking the status of your ERC claim online. If your ERC provider has a CAF number, you can log into the IRS portal and check your ERC refund status.

A CAF number is a unique nine-digit identification number that the IRS uses to keep track of authorized third-party tax service providers. It stands for Centralized Authorization File, and all legitimate tax servicers must have a CAF number in order to submit legal documents to the IRS on your company’s behalf. Before you choose an ERC provider, ask if they have an authentic CAF number. This ensures they are authorized by the IRS to provide tax services.

Get your Free ERC consultation!

Confidently claim your credit today! Get a free consultation with an ERC specialist and find out in 10 minutes if your business qualifies.